KEY FEATURE

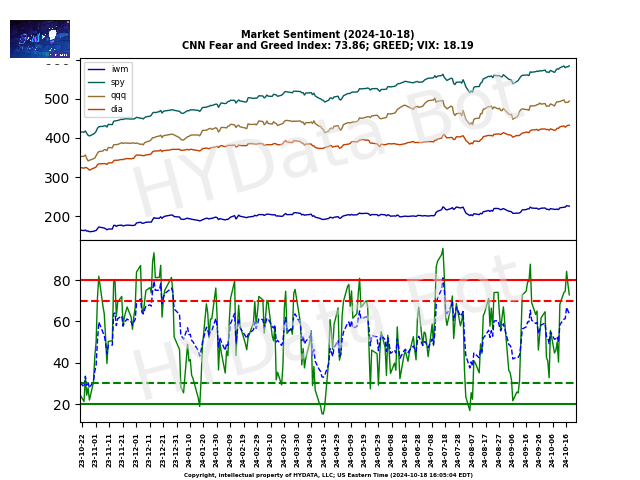

HYDATA is a financial analytics platform that provides advanced tools for traders and investors to monitor and analyze market trends, with a focus on options and stock market activities. It offers real-time insights into market sentiment, liquidity, and institutional trading behavior. HYDATA core features include:

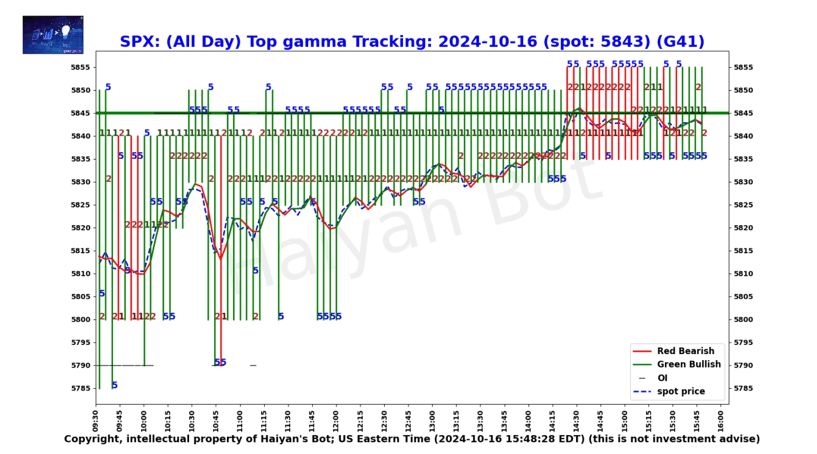

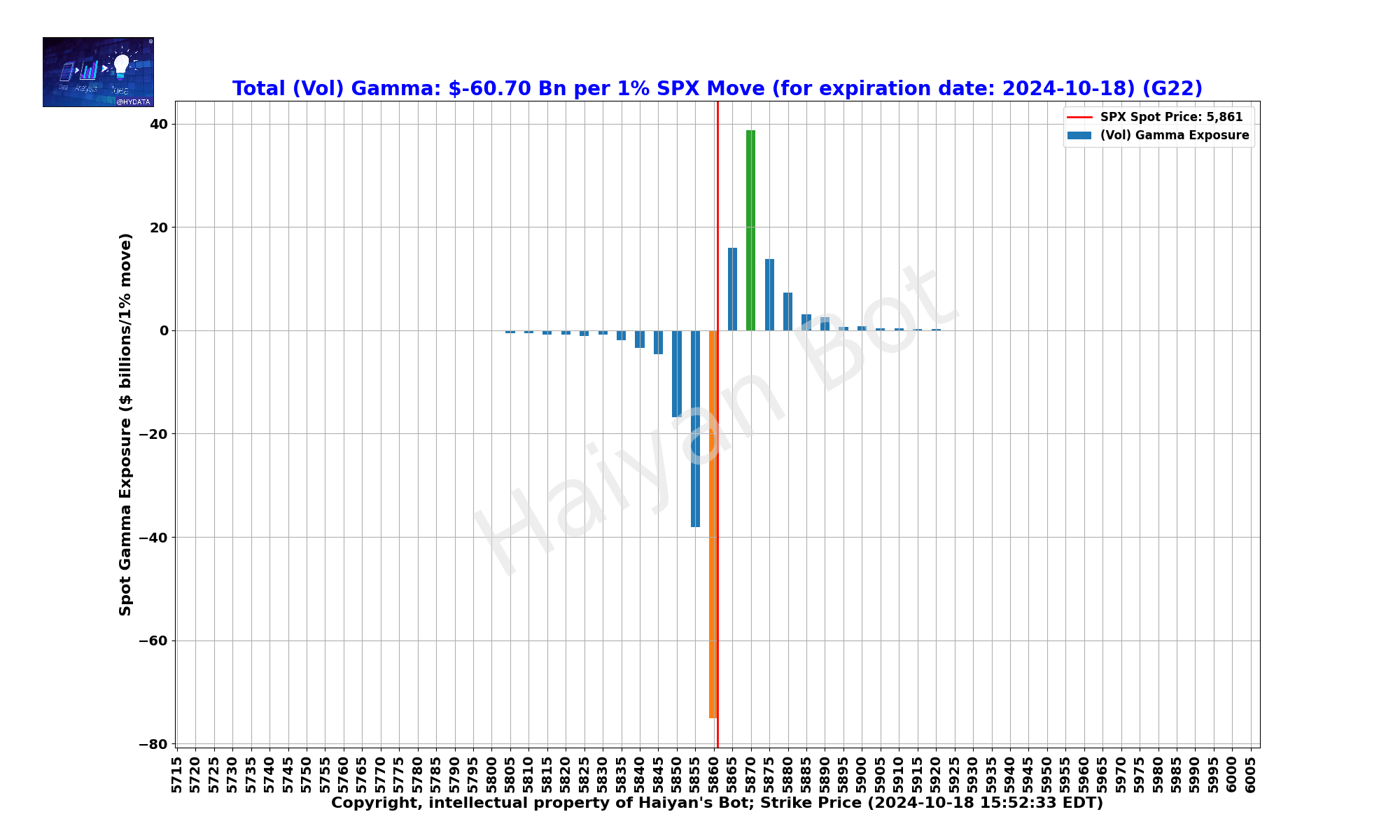

•Gamma Charts: These visualize the options market sentiment, helping users understand potential price movements by tracking gamma changes, which is the rate of change in an option’s delta.

•Volume Charts: Users can monitor trading volume trends to identify key market turning points, such as breakouts and reversals, providing critical liquidity insights.

•Dark Pool and Unusual Options Activity: This tool tracks large institutional trades in hidden exchanges (dark pools) and unusual options activities, giving users an edge by following where major investments are being made.

•Flow Analysis: The platform generates detailed analyses of stock trends using proprietary algorithms to track market liquidity and sentiment for individual stocks.

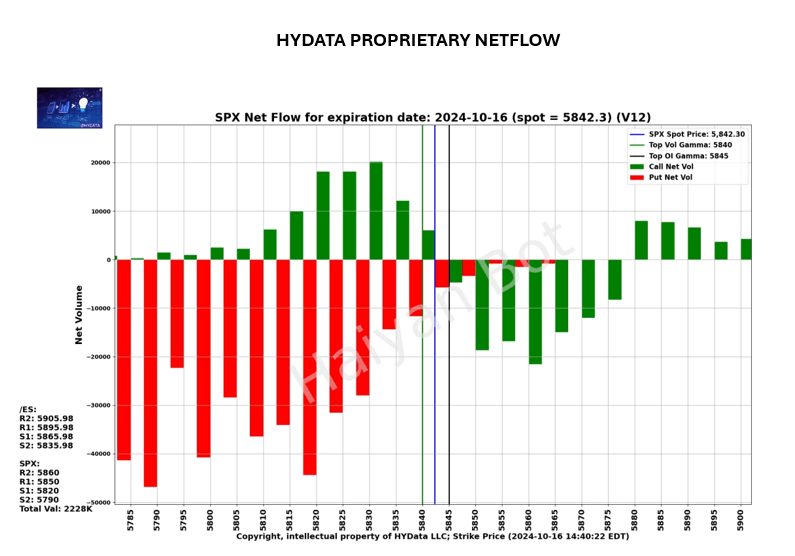

•Netflow and Total Market Value: It offers insights into the options market by analyzing buying and selling activities, assisting traders in making informed decisions.

•Simulated Automated Trading Alerts: HYDATA’s Automated Bot uses these tools to select optimal option strikes and premiums, sending simulated automated trade alerts to model different trading strategies.