MAKE SMARTER TRADING DECISION WITH HYDATA

EMPOWER YOUR TRADING DECISION

**All the analysis information is for reference only and doesn’t constitute an investment advice or recommendation.**

KEY FEATURES

HYDATA is an advanced financial analytics platform tailored for traders and Investors looking to gain a competitive edge in the stock and options markets. Our cutting-edge tools provide real-time insights into market dynamics, helping users identify profitable opportunities and stay ahead of market trends.

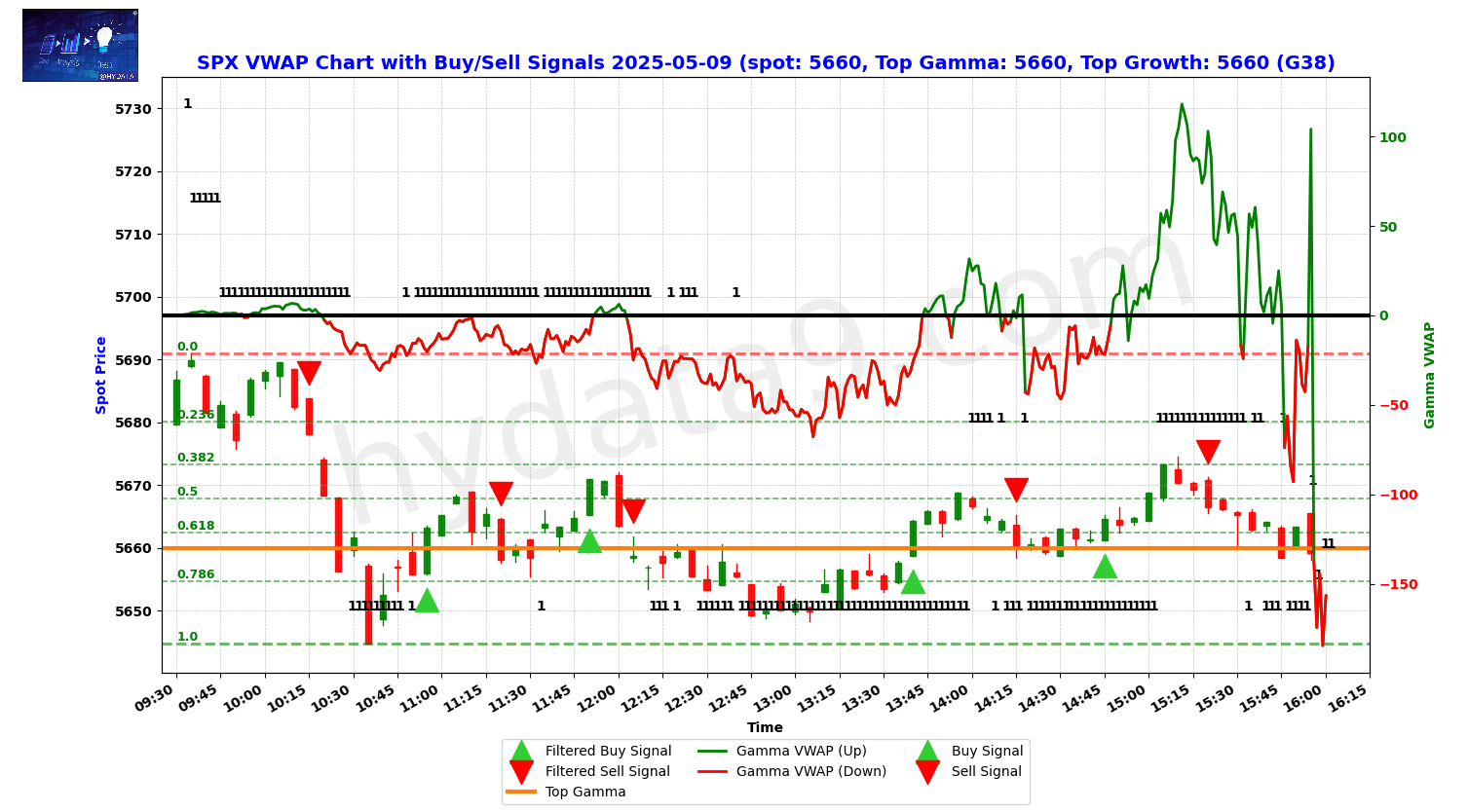

✔SPX GAMMA VWAP CHARTS

The SPX VWAP chart provides a visual integration of intraday price action, gamma exposure, and algorithmically filtered buy/sell signals to help identify key trend shifts and liquidity zones throughout the trading session.

📈 Gamma VWAP Trends

The Gamma VWAP line (green/red) helps indicate intraday flow dynamics:

Above 0: Gamma is adding positive feedback (bullish skew).

Below 0: Gamma implies downside momentum pressure.

🟢🔴 Buy/Sell Signal Highlights

Green triangle markers indicate filtered Buy Signals, typically when spot closes above multiple prior highs and meets volatility filter.

Red inverted triangles mark Sell Signals, triggered on multi-bar breakdowns below support and range-based filtering.

Signals are plotted on candlestick bars, with green/red candles reflecting intrabar price movement.

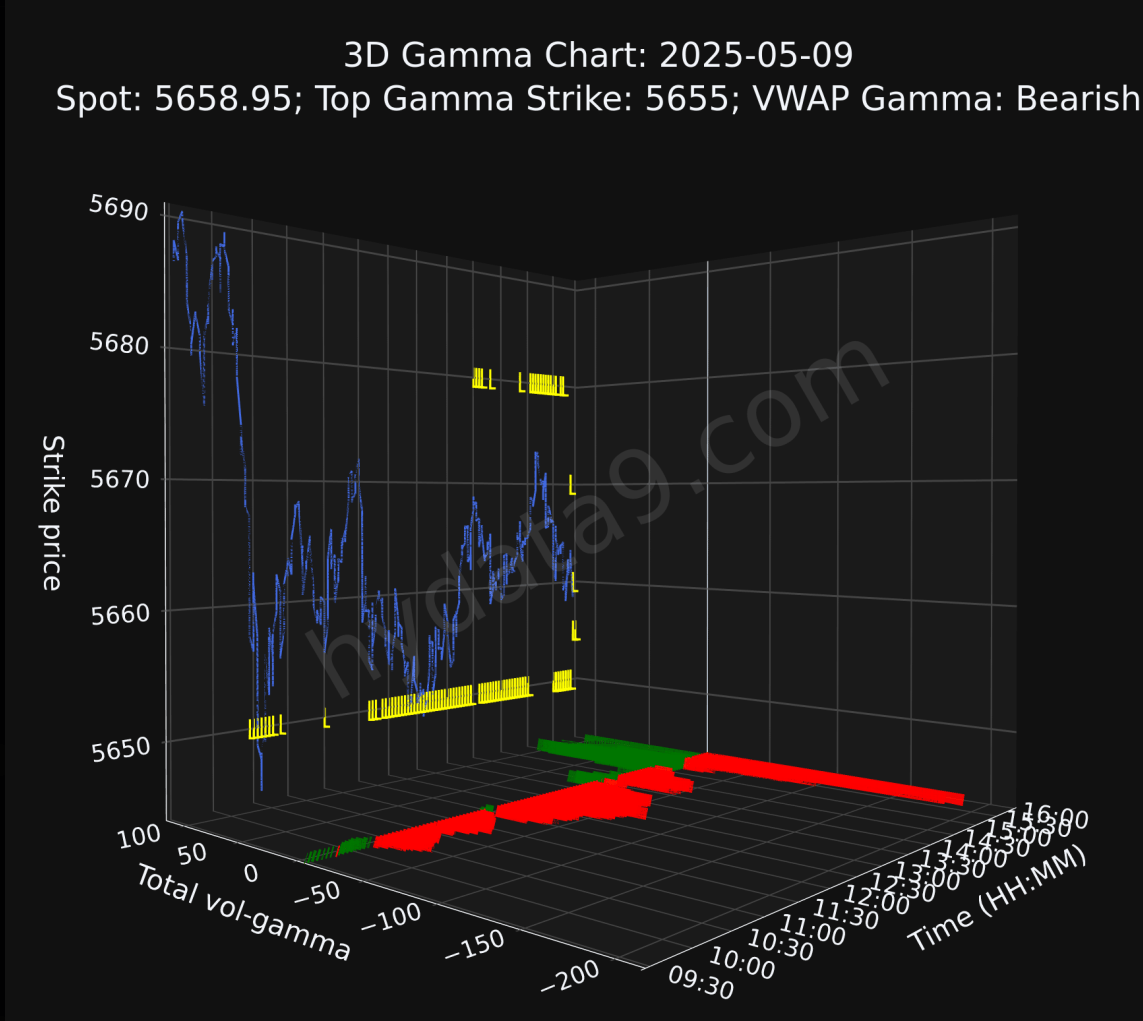

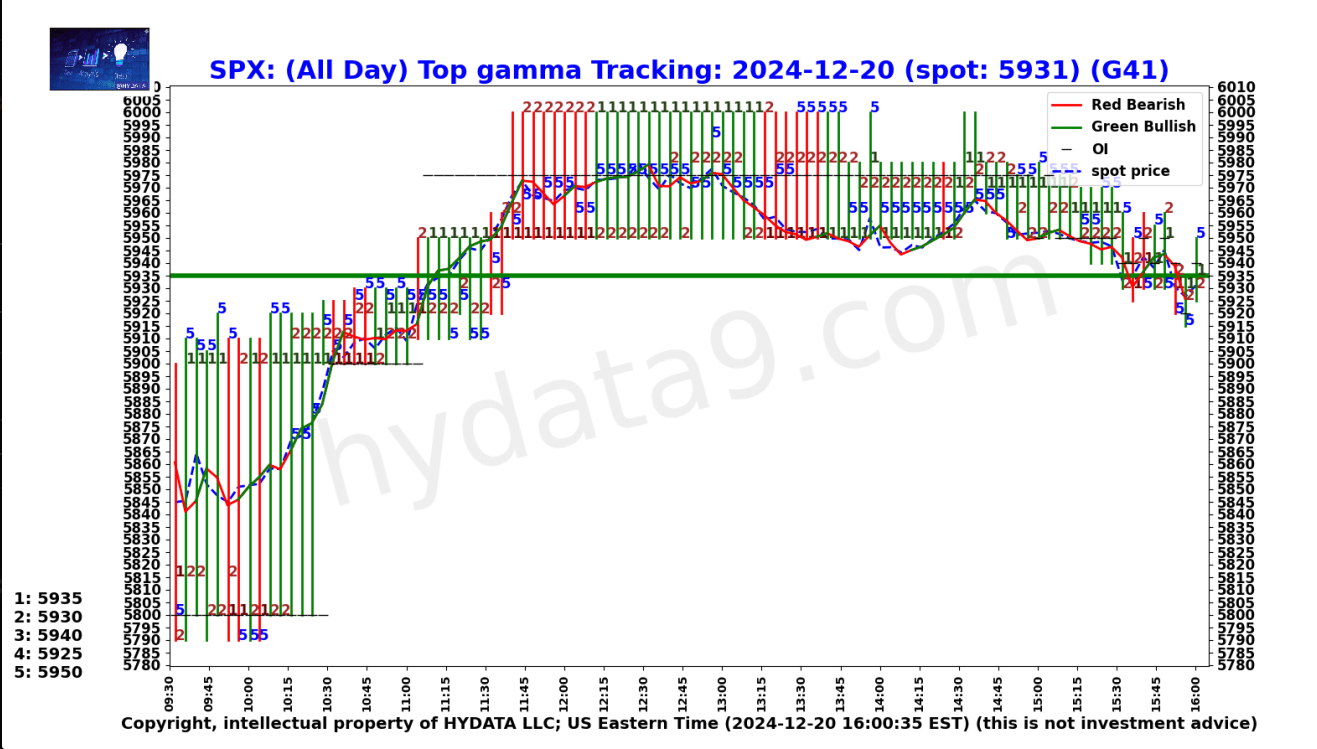

✔3D Gamma tracking

The 3D Gamma Chart provides a time-based visualization of total volume-adjusted gamma exposure across SPX strike levels. It highlights where MM positioning exerts pressure or support on price movement throughout the day

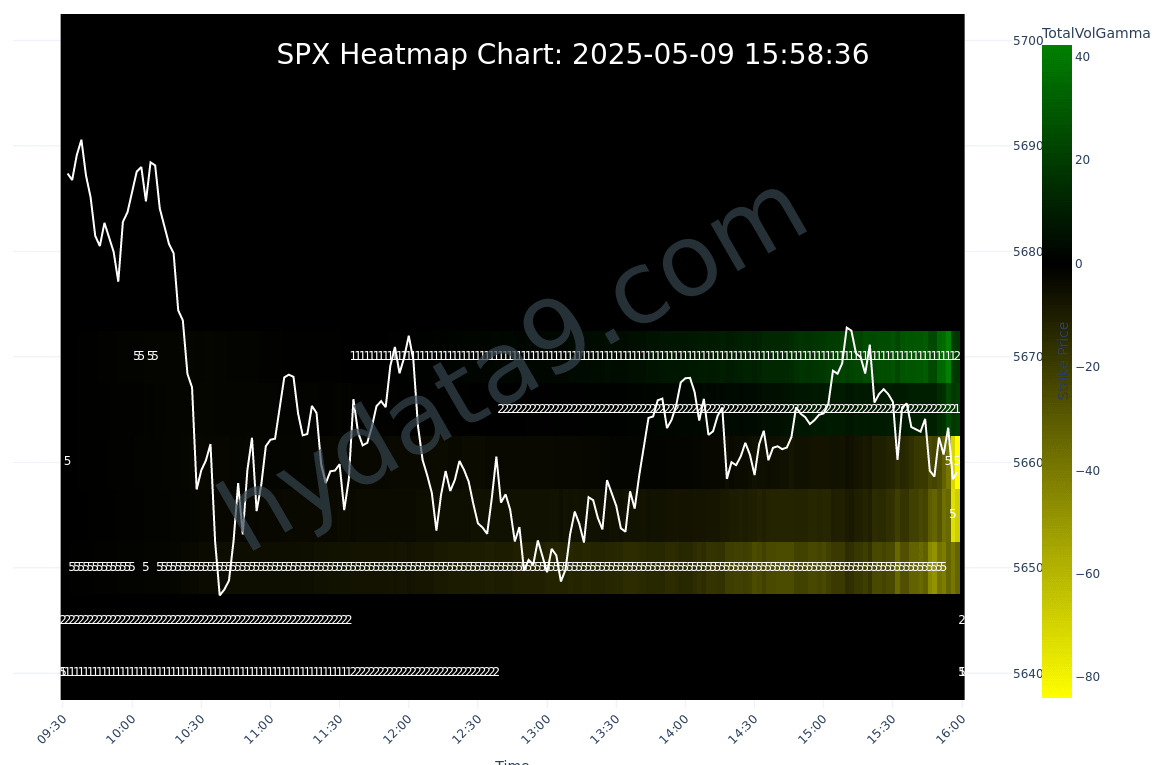

✔Top Gamma Heatmap

The SPX Heatmap Chart visualizes gamma concentration across strike levels and time, offering a clear view of where market makers may be positioned to hedge

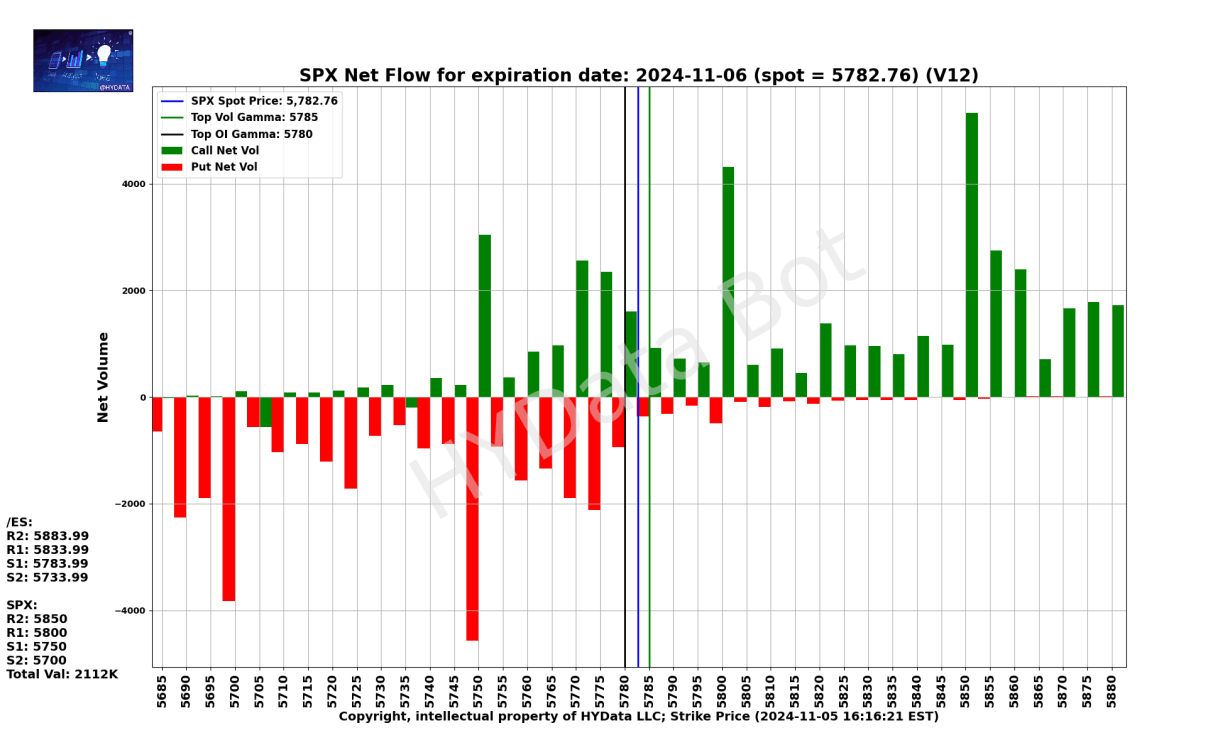

✔Gamma Charts – Understand Market Sentiment

Visualize changes in the options market sentiment by tracking gamma, the rate of change in an option’s delta. This helps predict potential price movements and market turning points.

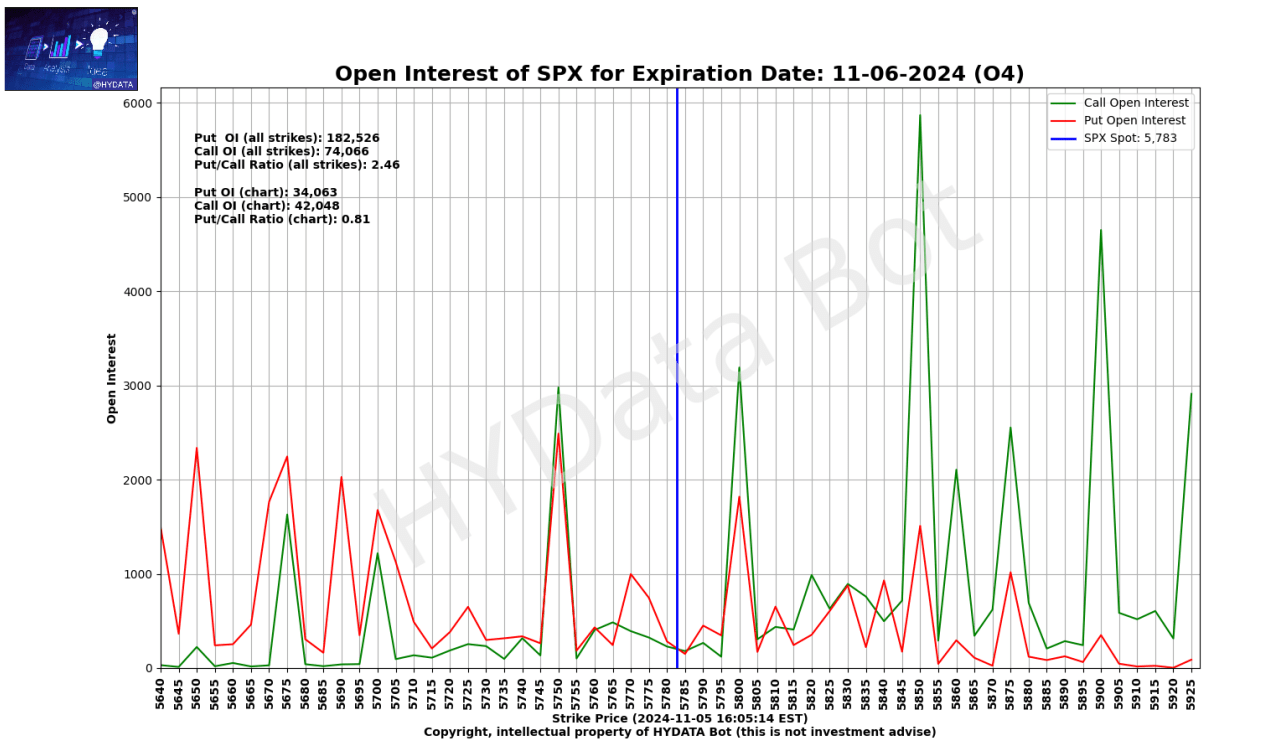

✔ Volume Charts – Monitor trading volume trends

Track trading volumes to identify breakouts and reversals. HYDATA’s volume charts provide crucial liquidity insights, helping traders spot key market movements.

✔Dark Pool & Unusual Options – Institutional Trades Activity

Get an edge by tracking large institutional trades in hidden exchanges (dark pools) and unusual options activity. This tool helps traders follow major investments and capitalize on market shifts.

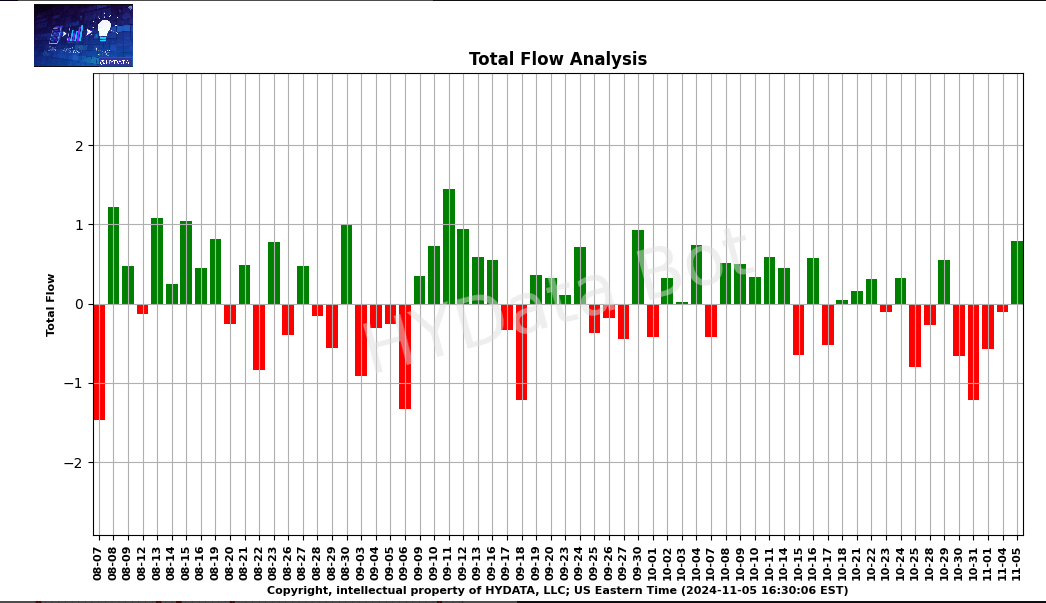

*Flow Analysis – Analysis Stock Trends

Leverage HYDATA’s proprietary algorithms to perform detailed flow analysis, offering insights into market liquidity and sentiment across individual stocks.

Netflow & Total Market Value – Understand Market Movement

By analyzing buying and selling activities within the options market, HYDATA helps users make informed decisions by offering a clearer view of market value and trends

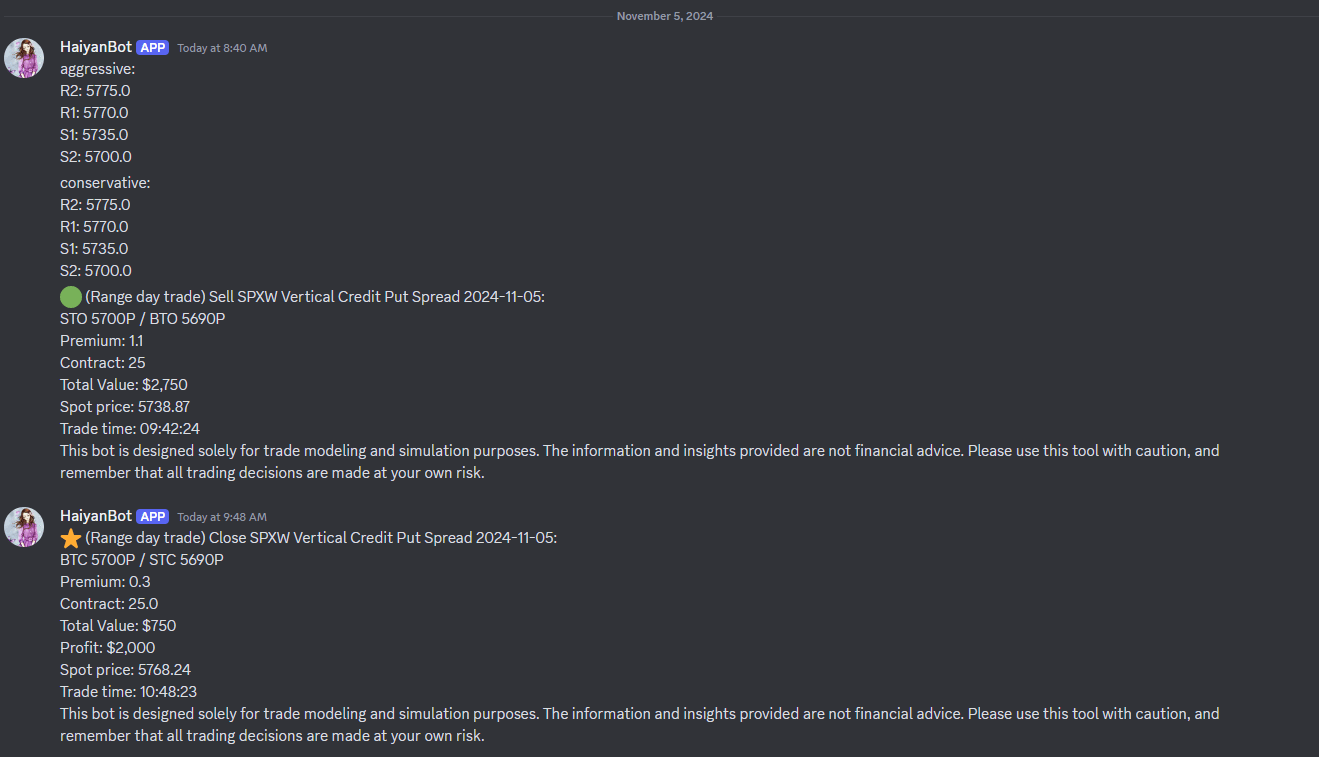

*Simulated Automated Trading Alerts – Test Trading Strategies

HYDATA’s Automated Bot uses market data to simulate optimal option strikes and premiums, generating automated trade alerts that allow traders to model and test different strategies without risk.

FUN EXPERIENCE

Greetings, fellow traders and financial enthusiasts! Whether you’re a seasoned investor or just dipping your toes into the world of trading, we’re thrilled to have you join us for an exciting journey through the intricacies of market analysis and trading strategies. So, get ready to embark on a journey where finance meets art, where complex market concepts are demystified through engaging visuals, and where learning is not only informative but also incredibly fun

✔Who Should USE HYDATA

HYDATA is designed for active traders, financial analysts, and institutional investors who seek real-time data and actionable insights to make better-informed decisions in the fast-moving stock and options markets.

✔Why Choose HYDATA

- Real-Time Insights: Stay updated on market shifts and trends.

- Institutional-Level Data: Access dark pool and unusual activity data.

- Simulated Trading: Test your strategies before committing capital.

- Comprehensive Analytics: Get a full view of market liquidity, sentiment, and trends.

HYDATA: Helping Traders Stay Ahead of the Market

HYDATA is a powerful platform that helps traders and investors keep track of market trends and make smart decisions. It’s designed to give you the tools you need to stay ahead of market changes and find profitable opportunities.

- Real-Time Data: HYDATA provides up-to-date insights on market conditions, money flows, and big institutional trades so you can make better decisions.

- Focus on Stocks and Options: Whether you trade stocks or options, HYDATA helps you track price changes, volume trends, and important trades from big players in the market.

- Advanced Tools: HYDATA offers specialized tools like gamma charts, dark pool data, and unusual trading activity tracking to give you a competitive edge.

Stay ahead of market changes, spot trends early, and take advantage of profitable opportunities with HYDATA’s real-time tools.